How Does a Wraparound Mortgage Work?

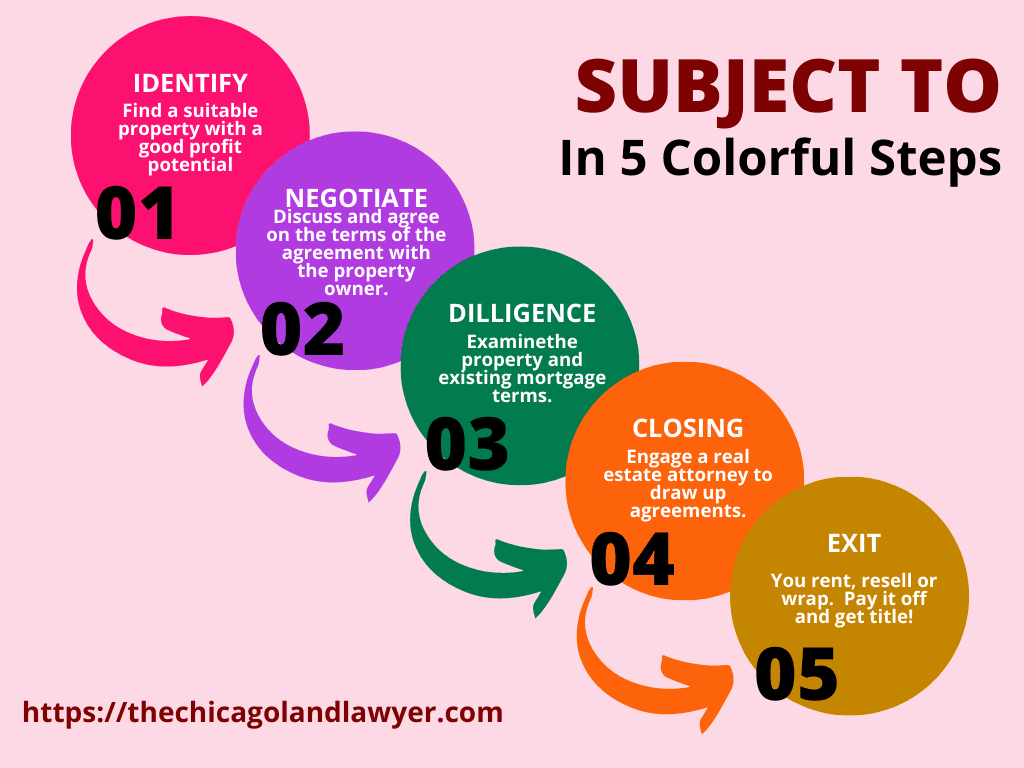

A wraparound mortgage allows a property seller to keep their original mortgage loan in place while they agree to finance the bulk of the purchase for a new buyer. The seller is effectively financing a subordinate mortgage for their buyer while keeping the original mortgage in place. It works much like a “subject to” purchase with a few key differences.

Mastering Creative Finance: Subject To and Wrap Mortgages

Mortgage - Wikipedia

What is a Seller Finance Wrap Around Mortgage

Realty411 Featuring Gene Guarino - Build a Legacy Vol 8. No. 4

:max_bytes(150000):strip_icc()/148168412-5c649cdb46e0fb000184a4ff.jpg)

Wrap-Around Loan: What it is, How it Works, Example

Home sellers can finance their low-rate mortgage and generate income – Orange County Register

What Is A Wraparound Mortgage?

REtipster with Seth Williams

Wrap Around Mortgage

Unveiling the Benefits of a Wraparound Mortgage: A Comprehensive Guide - FasterCapital

What Is a Wraparound Mortgage and How Does It Work?